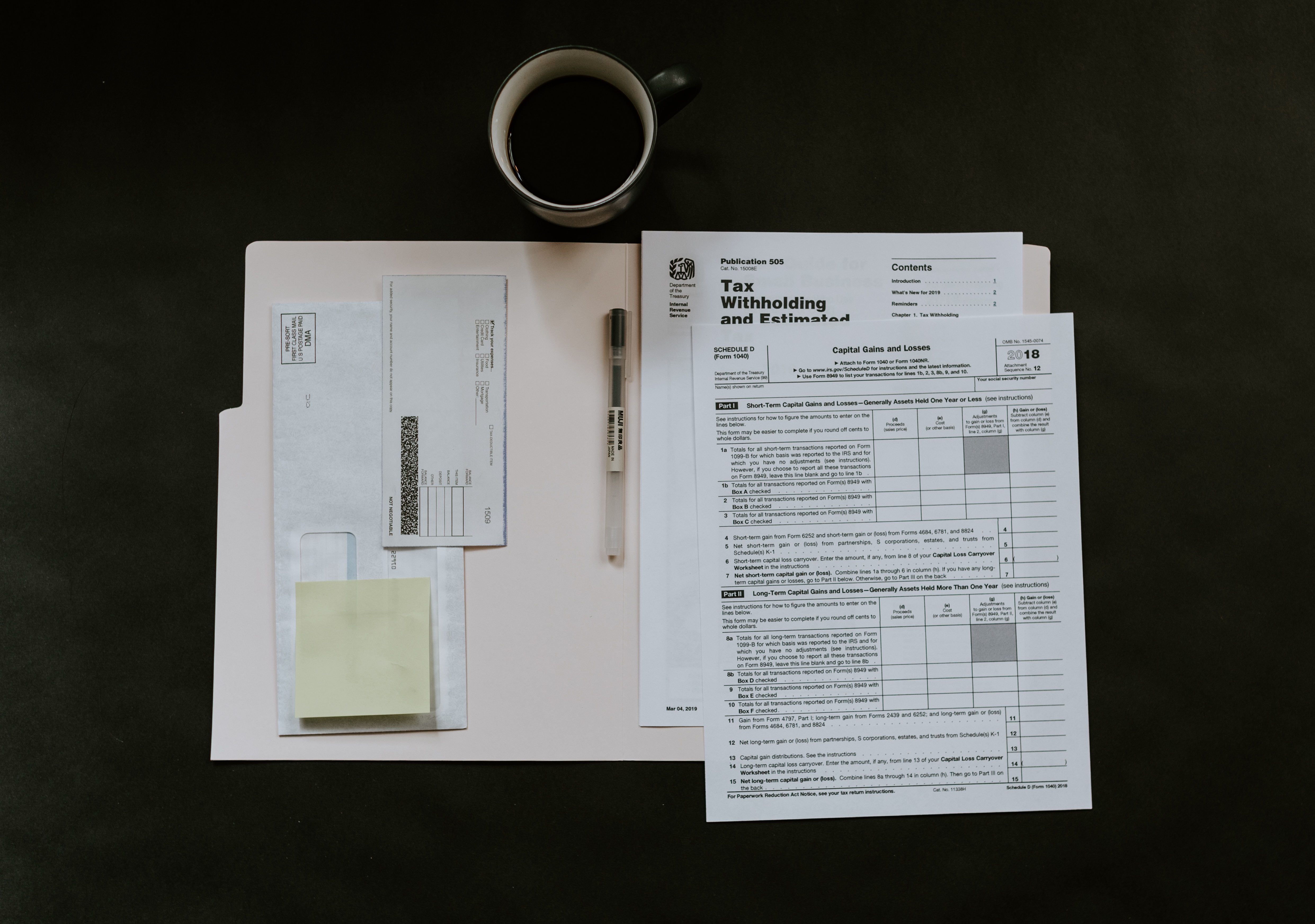

As Tax Day approaches, it’s a good time to think about how your investments, including real estate, can impact your tax situation. Real estate is an attractive investment for many reasons, and one of them is the potential tax benefits. In this post, we’ll explore some of the tax advantages of real estate investing and how you can take advantage of them.

Deductions for mortgage interest and property taxes

One of the most significant tax benefits of real estate investing is the ability to deduct mortgage interest and property taxes from your taxable income. For many homeowners, these deductions can add up to significant savings on their tax bill each year. Be sure to keep track of all your mortgage interest and property tax payments so you can take advantage of these deductions come tax time.

Capital gains exclusions

If you sell a property for a profit, you may be subject to capital gains tax. However, there are ways to reduce or eliminate this tax liability. For example, if you’ve lived in the property for at least two out of the past five years, you may be able to exclude up to $250,000 (or $500,000 for married couples) of your capital gains from your taxable income. This can be a significant benefit for investors who are looking to sell a property for a profit.

Depreciation

Depreciation is another tax advantage of real estate investing. It allows you to deduct a portion of the cost of your property over time, even if the property is appreciating in value. This deduction can help offset your rental income and reduce your tax liability. Be sure to consult with a tax professional to understand how depreciation works and how it can benefit your overall tax picture.

1031 exchanges

Finally, 1031 exchanges are another tax advantage of real estate investing. This provision allows you to defer paying taxes on the sale of a property if you reinvest the proceeds into another “like-kind” property. This can be a great way to avoid capital gains tax and continue to grow your real estate portfolio.

Real estate investing offers many potential tax benefits, from deductions for mortgage interest and property taxes to capital gains exclusions, depreciation, and 1031 exchanges. As with any investment, it’s essential to understand how your real estate holdings can impact your tax situation and to consult with a tax professional for guidance. By taking advantage of these tax benefits, you can maximize your investment returns and build long-term wealth through real estate.

Are you looking to buy or sell a home in South Carolina? Let the experienced agents at JPAR Magnolia Group help you find your dream home, investment property, or more. Our team of real estate professionals is dedicated to providing personalized service and expert guidance to help you navigate the complex real estate market. Contact us today to schedule a consultation and start your journey to homeownership or investment success.